Our System

We offer the potential return of up to 200% on your investment. Once you have received your 200% profit, we will return your initial investment amount, at which point our agreement will be concluded.

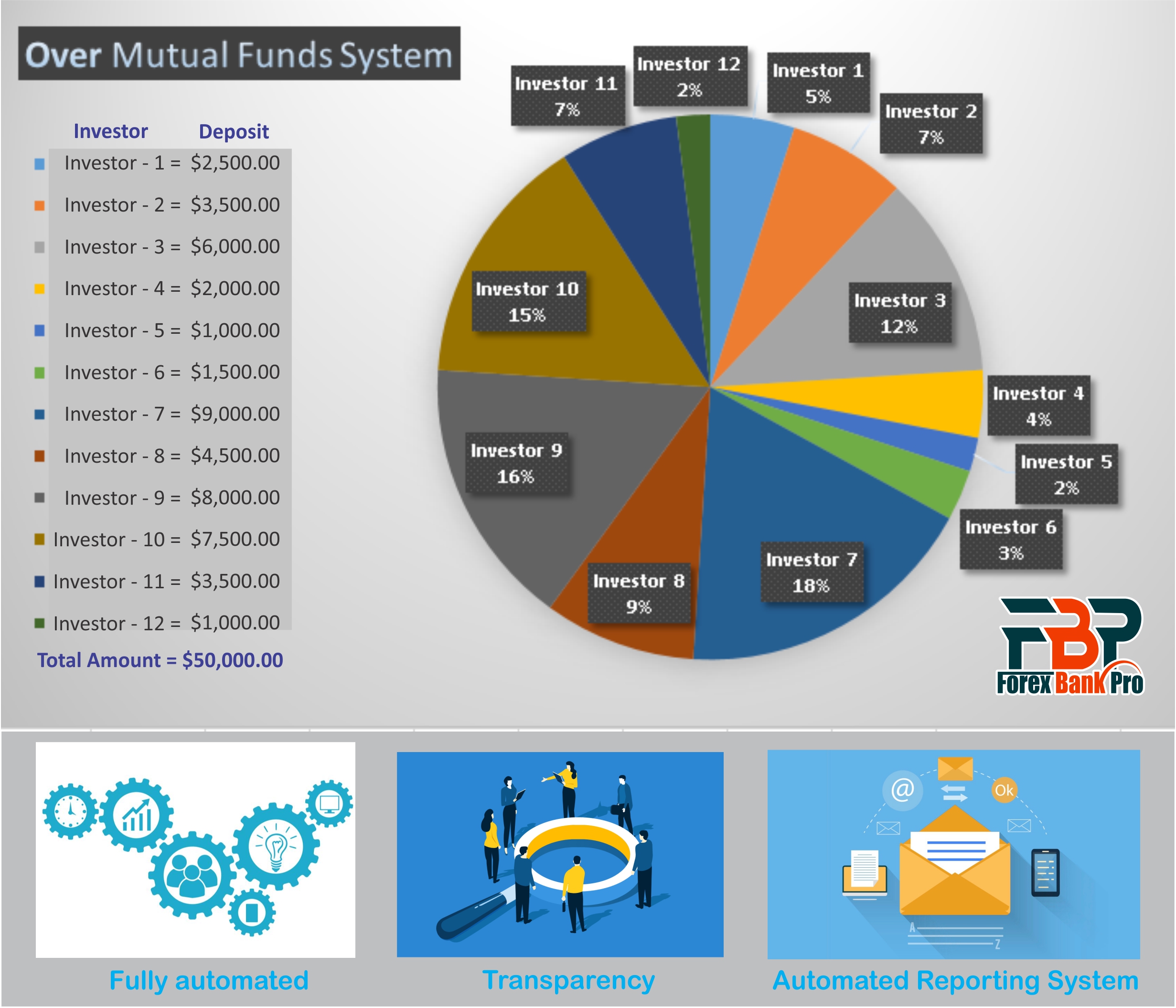

At the end of each business day, you will receive a detailed report on the performance of your investment account. This is structured as a Mutual Account, which provides enhanced security compared to traditional accounts. In this system, all accounts are interconnected, allowing smaller accounts to benefit from the stability and performance of larger ones. This interconnected structure ensures greater safety, particularly for smaller investors, as they are supported by the collective strength of the larger accounts..

This is a Mutual Account, so it's safer than a regular account. Here all accounts are linked to one account and you copy the % of profit. So for small accounts it's alot safer as it get supported by bigger accounts.

Introduction of Mutual Funds:

In the realm of investment opportunities, mutual funds have stood out as a popular and effective option for investors seeking diversified exposure to various asset classes. When it comes to investing in the forex market, mutual funds can offer a structured and efficient way to navigate the complexities and risks associated with currency trading. The partnership between mutual funds and Forex Bank Pro can provide investors with a unique avenue to participate in the forex market while benefiting from professional management, diversification, accessibility, and risk management strategies.

Mutual Funds and Their Benefits:

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of securities, such as stocks, bonds, and commodities. In the context of Forex Bank Pro, mutual funds can offer several advantages that make them a better way of investment in the forex market.

One of the key benefits of mutual funds is diversification. By investing in a mutual fund through Forex Bank Pro, investors can spread their investment across a wide range of currencies and assets, reducing the risk associated with concentrating their funds in a single currency pair or market. Diversification helps mitigate risk and provides a buffer against volatility in the forex market.

For example, Forex Bank Pro could offer mutual funds that invest in a mix of major and emerging market currencies, commodities, and currency derivatives. This diversified approach can help investors capture potential opportunities across different currency pairs and regions while minimizing the impact of any adverse movements in a specific currency.

Mutual funds are managed by EA who make investment decisions on behalf of investors. This EA conduct research, monitor market trends, and adjust the fund's portfolio based on their analysis and market conditions. In the case of Forex Bank Pro, investors can benefit from the expertise of professional EA who specialize in forex trading and have a deep understanding of the factors influencing currency movements.

For instance, the EA at Forex Bank Pro could leverage it's knowledge of macroeconomic indicators, geopolitical events, and technical analysis to make informed decisions regarding currency selection, position sizing, and risk management. This active management approach can potentially enhance returns and reduce downside risk for investors compared to individual trading.

Investing in mutual funds through Forex Bank Pro offers investors of all levels easy access to the forex market. Whether an investor is a beginner looking to diversify their portfolio or an experienced trader seeking exposure to specific currency pairs, mutual funds provide a convenient and regulated avenue to participate in forex trading.

Forex Bank Pro could offer a range of mutual fund options catering to different investor preferences and risk profiles. For example, investors can choose from funds that focus on major currency pairs, exotic currencies, or thematic trading strategies. This accessibility allows investors to tailor their investment approach to align with their investment goals and risk tolerance.

Another benefit of investing in mutual funds through Forex Bank Pro is effective risk management. Mutual funds offer a range of investment options designed to suit varying risk profiles, from conservative to aggressive. By selecting funds that match their risk tolerance, investors can create a well-balanced portfolio that aligns with their financial objectives and time horizon.

For instance, Forex Bank Pro could offer mutual funds that combine low-risk currency pairs with higher-risk emerging market currencies to provide a balanced risk-return profile. Additionally, the use of hedging strategies, stop-loss orders, and risk control measures by fund managers can help protect investors' capital and limit potential losses in the forex market.

In conclusion, investing in mutual funds through Forex Bank Pro can be a better way of gaining exposure to the forex market for a wide range of investors. By leveraging the benefits of diversification, professional management, accessibility, and risk management offered by mutual funds, investors can potentially enhance their returns while minimizing risk in the volatile forex market. Whether you are a new investor looking to diversify your portfolio or an experienced trader seeking expert guidance, mutual funds at Forex Bank Pro can provide a structured and efficient avenue to participate in currency trading.

The Mutual Accounts service allows investors to earn on Forex without trading on their own and EA to get additional income through efficient management of investor’s funds.

Mutual stands for a percent allocation management module. It is a software application generally used for pairing client funds with a special discretionary account service provided by foreign exchange brokers. The EA trading activity results - including profits, losses and trades - are compounded among central asset accounts accordingly to the ratio of investment on an account. As the currency dealing and other types of arbitrage operations attain profit-making capacity within very straitened margins, this type of management enables more currency to be engaged in trading while the risk is distributed usually between investors.

For Investors

Return

The potential of the Forex market is 200%. You can earn high returns by investing in a Mutual account or Mutual portfolio without being skilled at trading.

Transparency

The Mutual service recently underwent a thorough compliance check by an international auditing firm in order to ensure that all operations and practices were in line with industry regulations and standards. The audit involved a comprehensive review of internal policies, procedures, and controls to assess the company's adherence to legal requirements and ethical guidelines. You can see the results of the audit for yourself in Forex Bank Pro.

During the audit process, the auditing firm examined various aspects of The Mutual service, including data security measures, customer privacy practices, and financial reporting accuracy. The audit also included interviews with key stakeholders and a review of documentation to verify compliance with international standards and best practices.

After a rigorous evaluation, the auditing firm confirmed that The Mutual service was fully compliant with all relevant regulations and standards. This validation not only demonstrates The Mutual service's commitment to operating with integrity and transparency but also provides reassurance to customers and partners that their data and investments are secure and well-protected.

Moving forward, The Mutual service will continue to prioritize compliance and ethical conduct in all aspects of its operations to maintain trust and confidence among stakeholders. By undergoing regular audits and assessments by reputable firms, The Mutual service aims to uphold the highest standards of accountability and professionalism in the financial services industry.